Direct to consumer (D2C) strategies have become all the rage in streaming producing Paramount+, Disney+ and Disovery+ from a list of many more. What is it that broadcasters are capitalising on by doing this and how do they get on with their rivals and partners, the telcos? This panel from Dataxis, moderated by Julian Clover probes to find out more.

Lydia Fairfax who leads partnerships for Discovery+ starts by saying that the strategy is to maintain the investment in linear channels, which have just seen their strongest Q1 ratings. This is done by working the budgets for linear alongside an incremental budget for Discovery+ which allows them to mirror their younger demographic by producing shows for that demographic which can then be trialled on the linear channels to understand what content will carry well. This is all part of a bid to ensure that Discovery+ content can have a life on linear so that investment is also not wasted. Work is ongoing to see whether showing the first episode of new content on a free to air (FTA) channel first and driving viewers to Discovery+ is a good way forward to whether releasing to FTA after an initial Discovery+ exclusivity window is the best way to maximise the value of content.

Antonella Dominici from TIMvision explains the role of TIMvision as, for the most part, an aggregator that works with big names like Discovery, Eurosport, Sky and many others to deliver a sophisticated offering to its Italian audience. Making its own content as well, Antonella explains they aren’t going up against Netflix, rather they are seeing specific niches in Italian TV and filling them with their original content. However, another USP over streaming giants is that they also deliver the major linear channels that Italians watch such as Sky Italy and RAI.

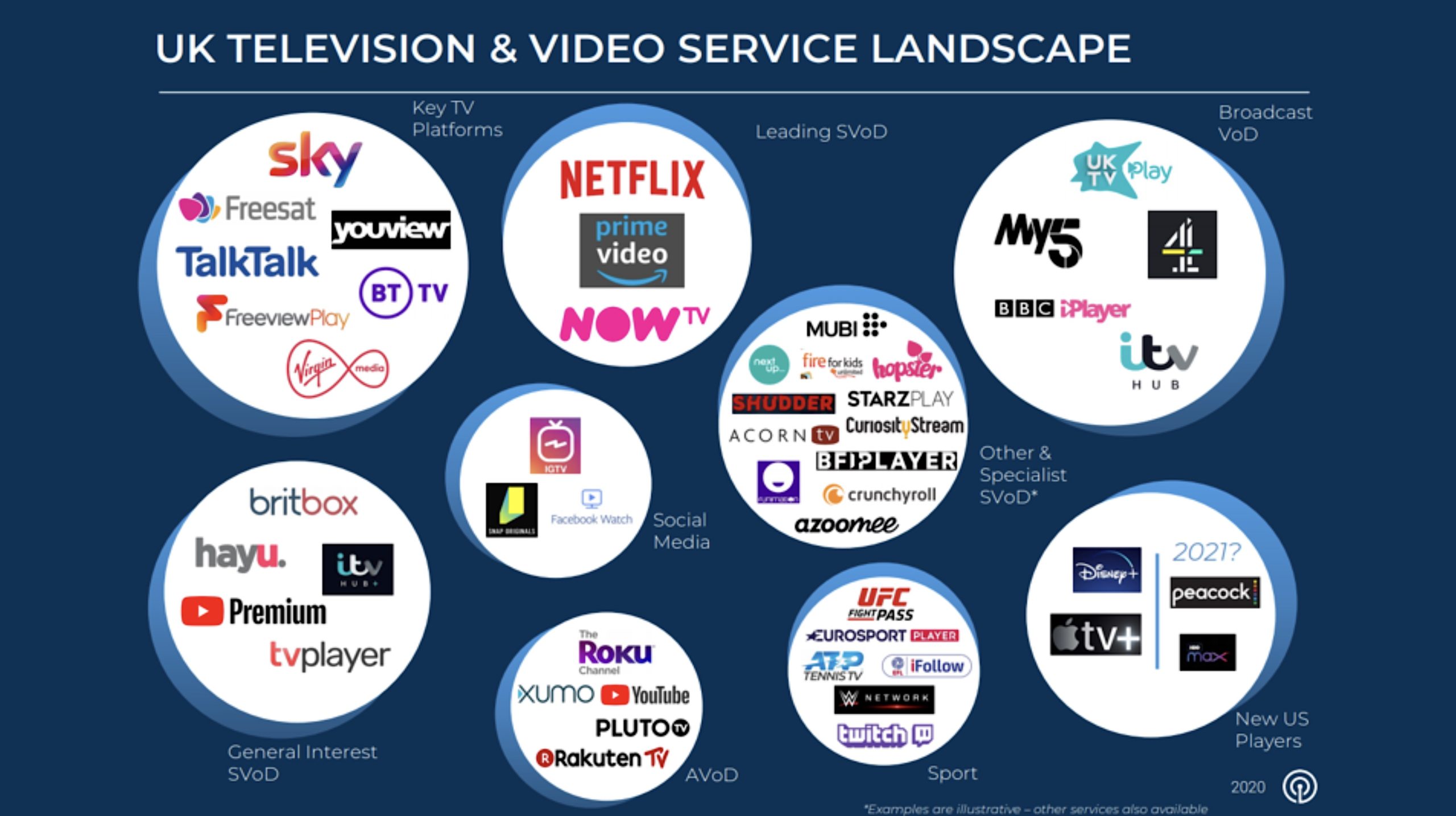

A different perspective is offered by Bulsatcom CEO Stanislav Georgiev. Now 21 years old, it’s well known in Bulgaria as a DTH platform and it’s Stanislav’s job, he says to make their OTT offering a major part of their business. They have the benefit of being a trusted brand and Stanislav sees their role as almost purely an aggregator. Turning to a question on the continued relevance of STBs, he says that the set-top box brings ‘order to the chaos’

The STB is still very much present, says Peter Røder Lristensen of 24i and whilst Android TV is growing both in STBs and on TVs, Peter says it’s not a matter of choosing the best, rather you need to be on every device else you’re not relevant. STBs have their benefits, Lydia reinforces, allowing broadcasters to push their brand and offer a shortcut from their linear channels direct to the Discovery+ app using the red button. Antonella says that she sees the STB catering to the ‘lean back’ viewers who much more want to be guided as to what to watch. She says that people who know what they want will just go into the app and search for it. Peter adds that creating consistency and integration across all the devices is key including using Google Voice as a starting point.

Watch now!

Speakers

|

Lydia Fairfax SVP, Head of Commercial Partnerships, EMEA Discovery |

|

Antonella Dominici Vice President TIMVISION & Entertainment Products TIM |

|

Peter Røder Kristensen Product Management, 24i |

|

Stanislav Georgiev CEO Bulsatcom |

|

Julian Clover Editor, Broadband TV News |